Payroll: Overview

Section description

The "Payroll" subsection in the "Finance" section allows the admin to initiate and review payroll data for each payment period. Information, including work data, absence days, and applied benefits, is automatically retrieved from employee profiles.

Admins can add additional payrolls for different categories of employees, such as those with monthly salaries or different paydays. This provides flexibility in accounting for various salary payments and employee work schedule peculiarities.

The "Payroll" subsection allows the admin to conduct accurate and systematic payroll calculations, considering all necessary factors for each employee.

Features list

- Running payroll

- Payroll Overview

- Approving payroll

- Adding a new payroll

- Editing payroll

- Deleting payroll

Feature Overview

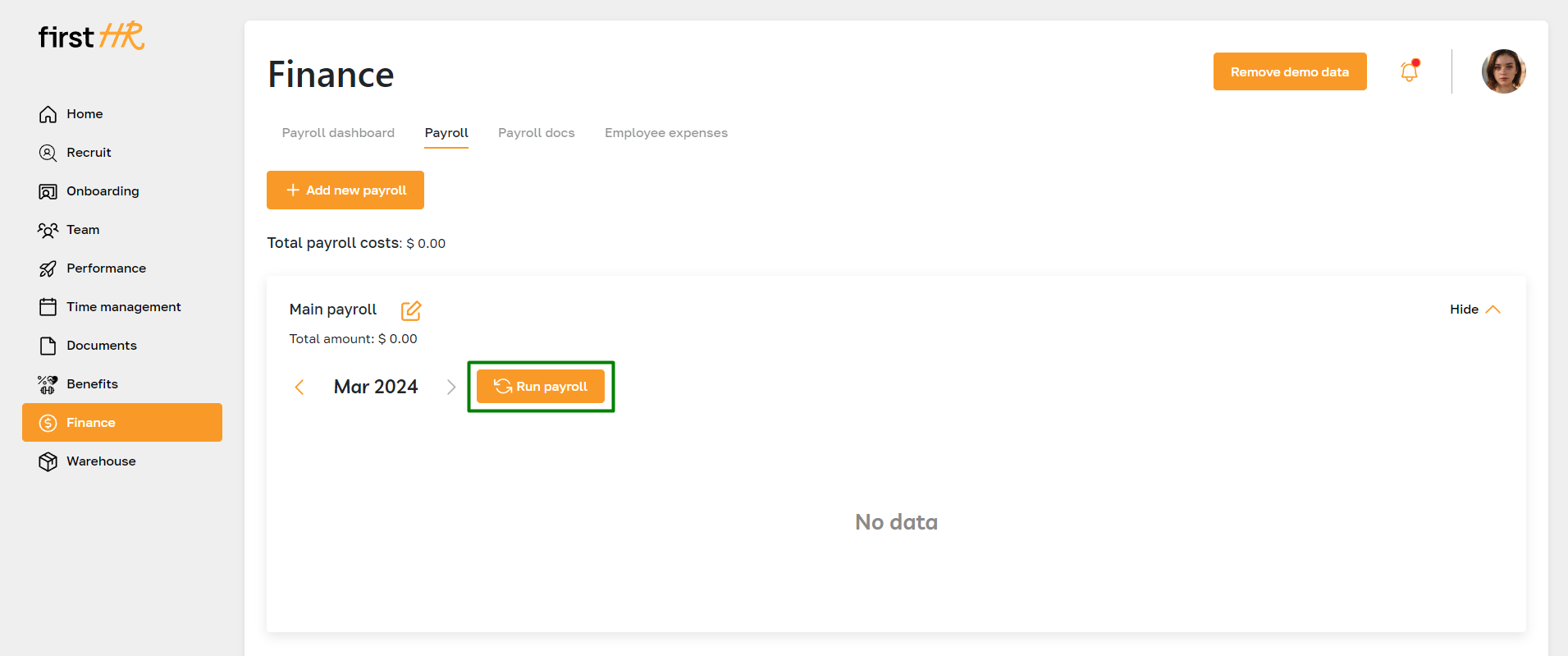

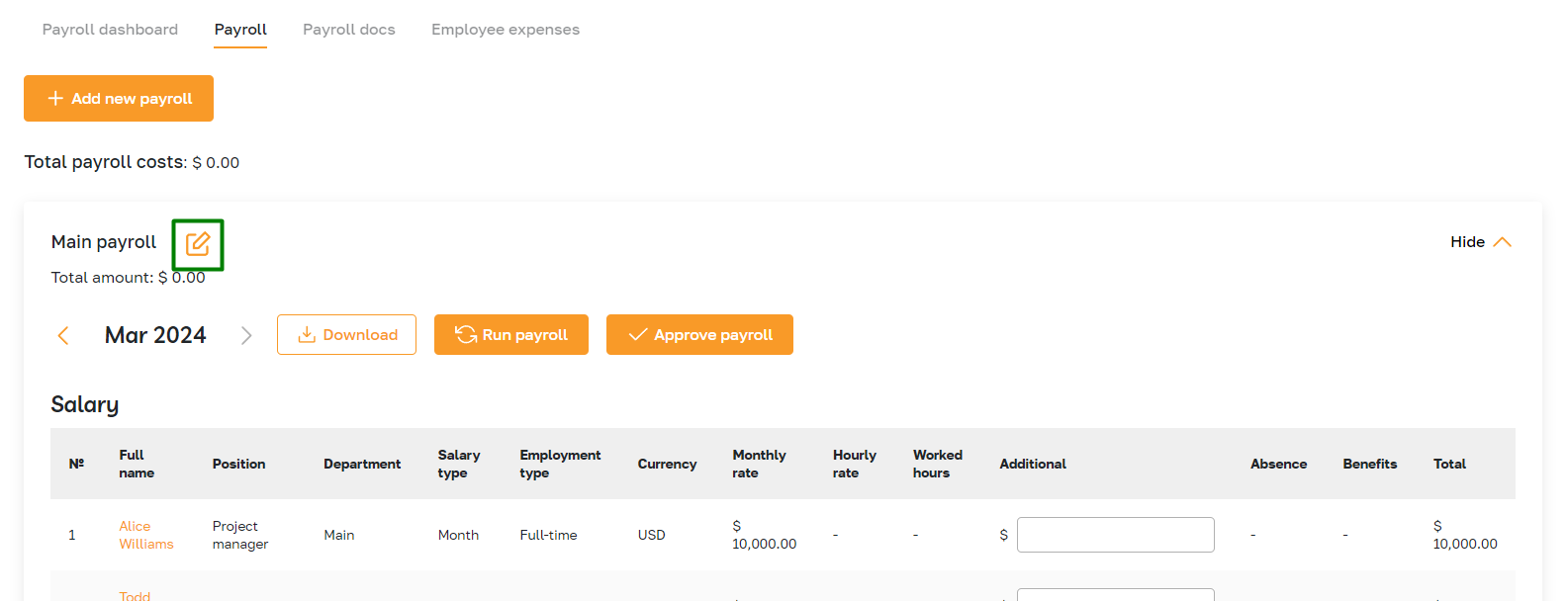

Running payroll

This function involves initiating the payroll process for a specific period. The system calculates employee payments based on working hours, salaries, deductions, and other factors. The admin typically initiates this process at the end of each pay period to ensure employees receive their wages on time.

To run the payroll, click on the highlighted button.

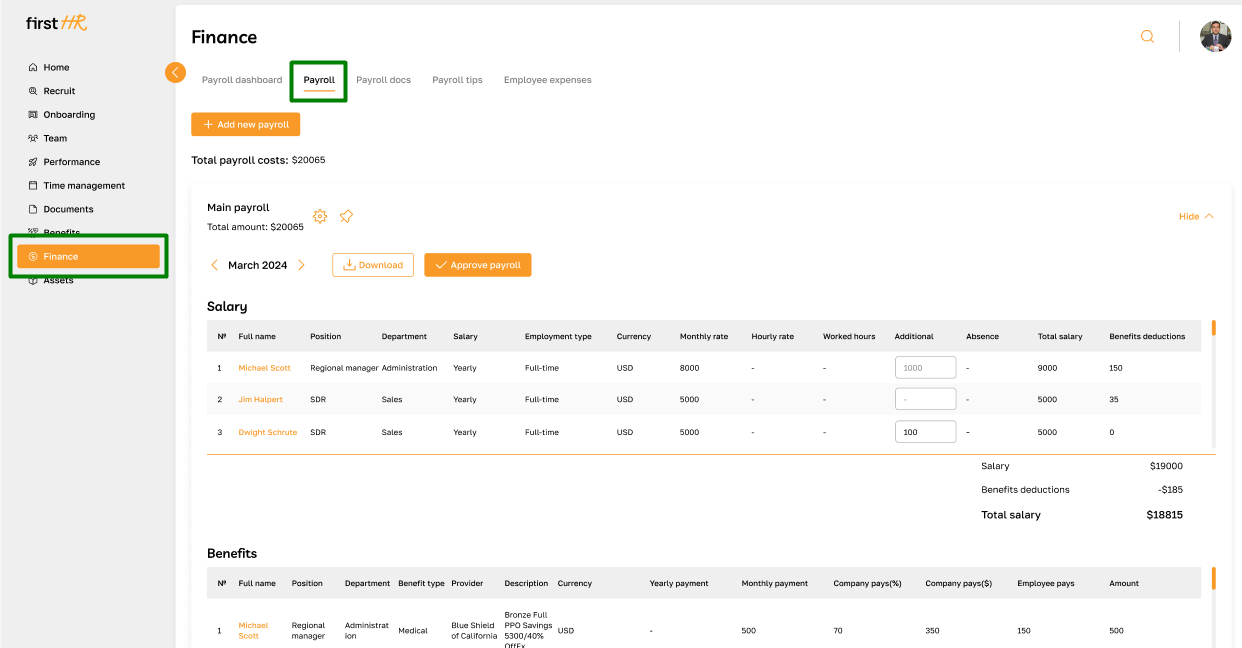

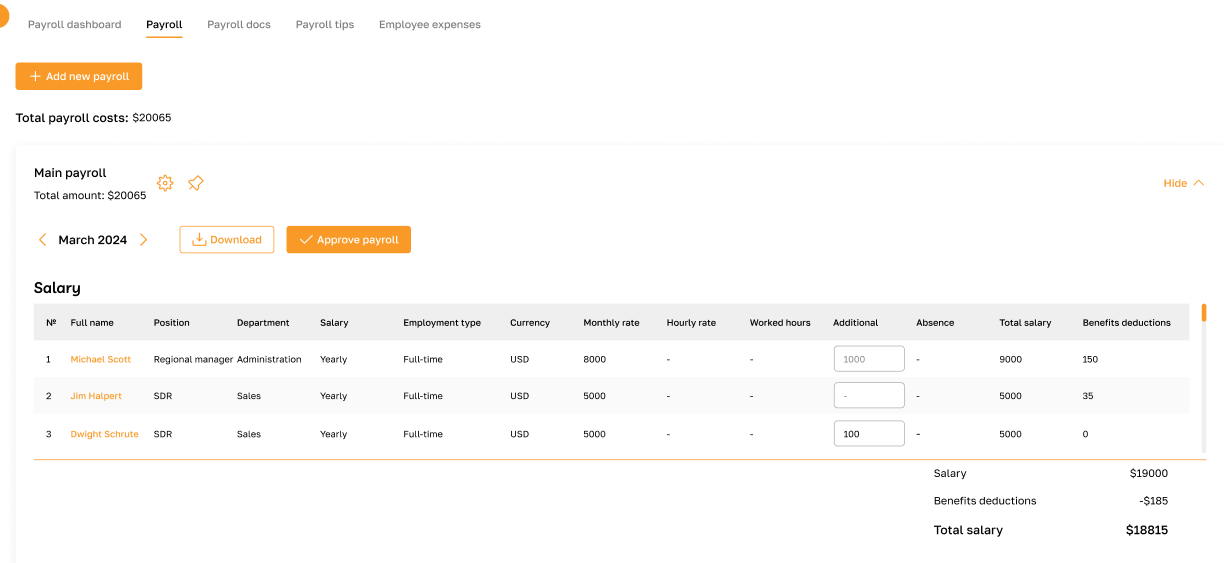

Payroll Overview

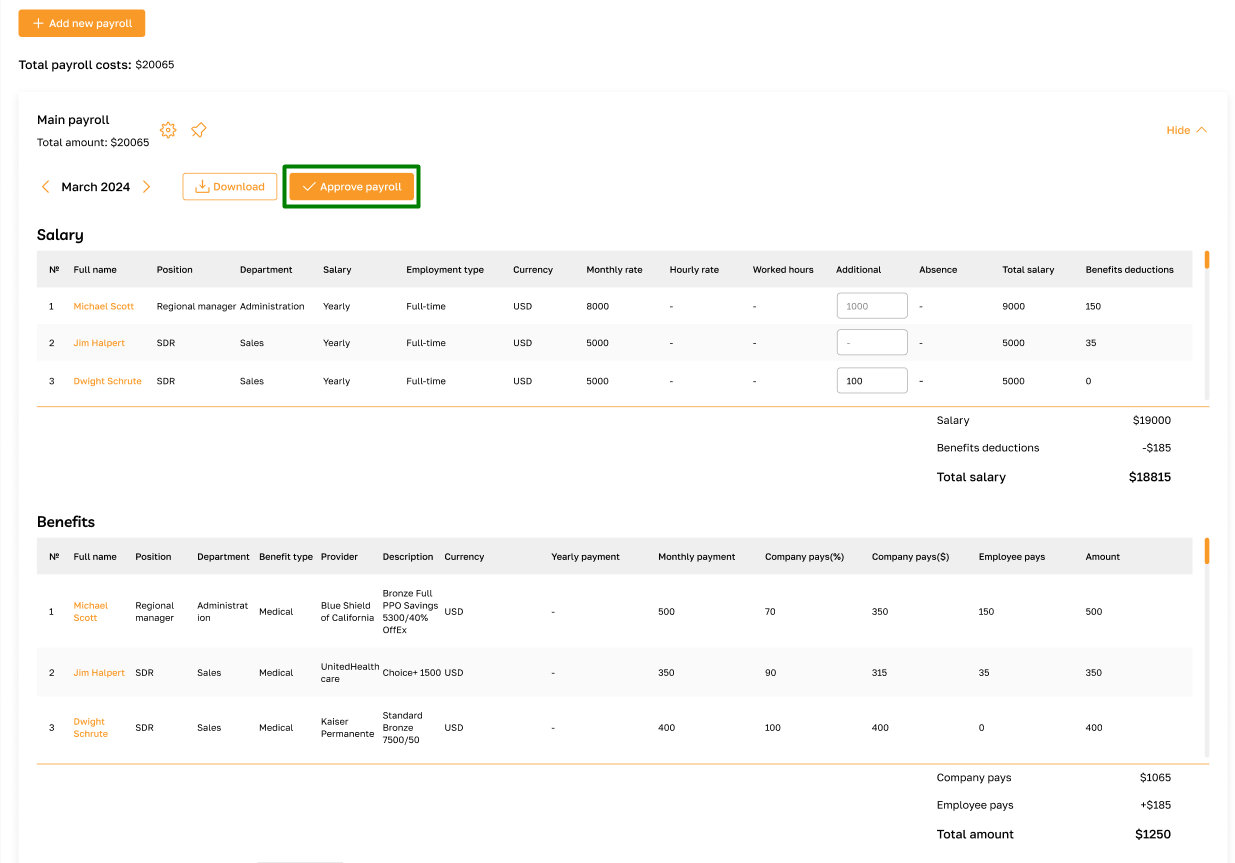

Each payroll consists of several blocks:

Salary: This section contains a table about employees and their salaries. Each row represents an employee, and the columns contain the following data: full name of the employee, their position, department, type of salary (monthly, hourly, etc.), employment type (full-time, part-time, etc.), currency, monthly or hourly rate, worked hours (data generated based on the Time Management section), additional earnings (filled in manually by the admin), absences (data generated based on the Absence subsection), benefits (data generated based on the Company benefits subsection), and the total payout amount.

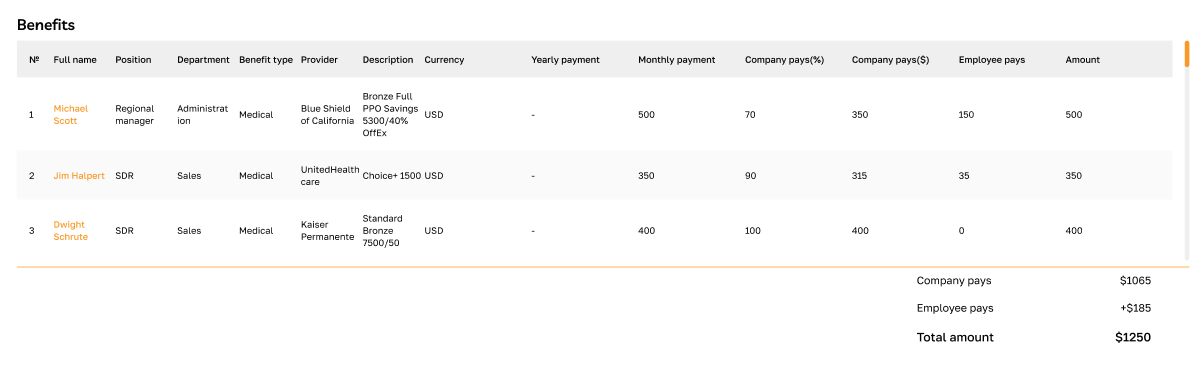

Benefits: This section presents employees's benefits. Each row includes information about the benefit and the employee, such as the full name of the employee, their position, department, type of benefit, provider, description, currency, price, information about spouse(s) and children, percentage of company contribution, amount contributed by the company, amount contributed by the employee, and the total amount.

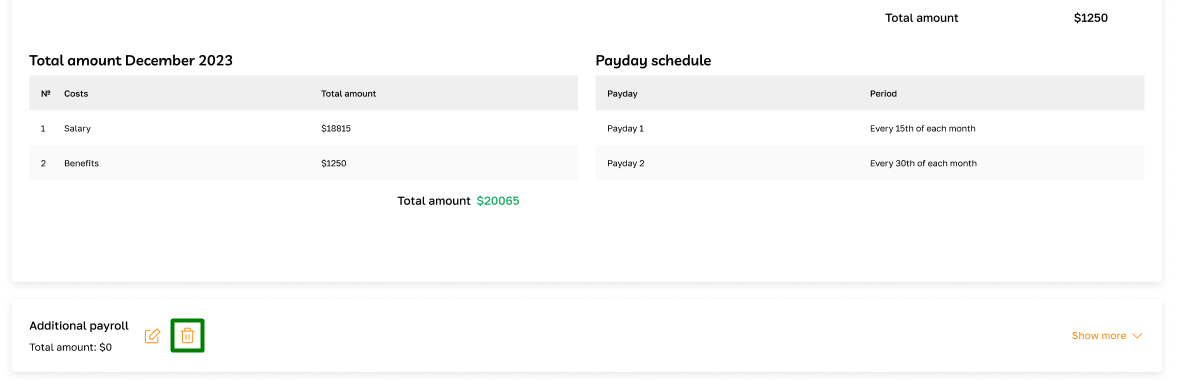

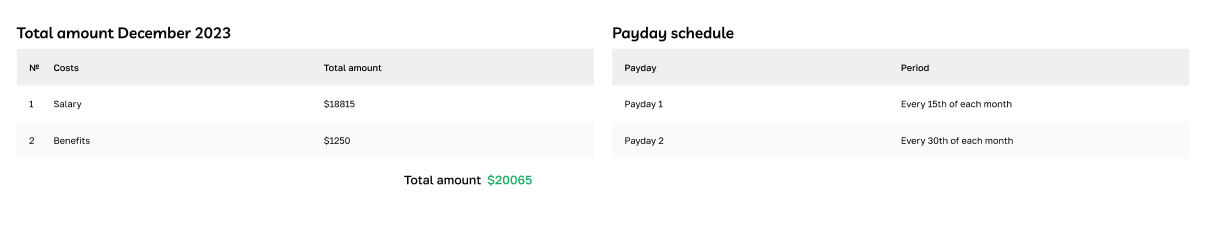

Total Amount: This block displays the total salary and benefits for the current month, combining data from the previous two blocks.

Payday schedule: This block provides information about the dates and frequency of employee salary payments.

You can switch between months and collapse the payroll for easier data viewing.

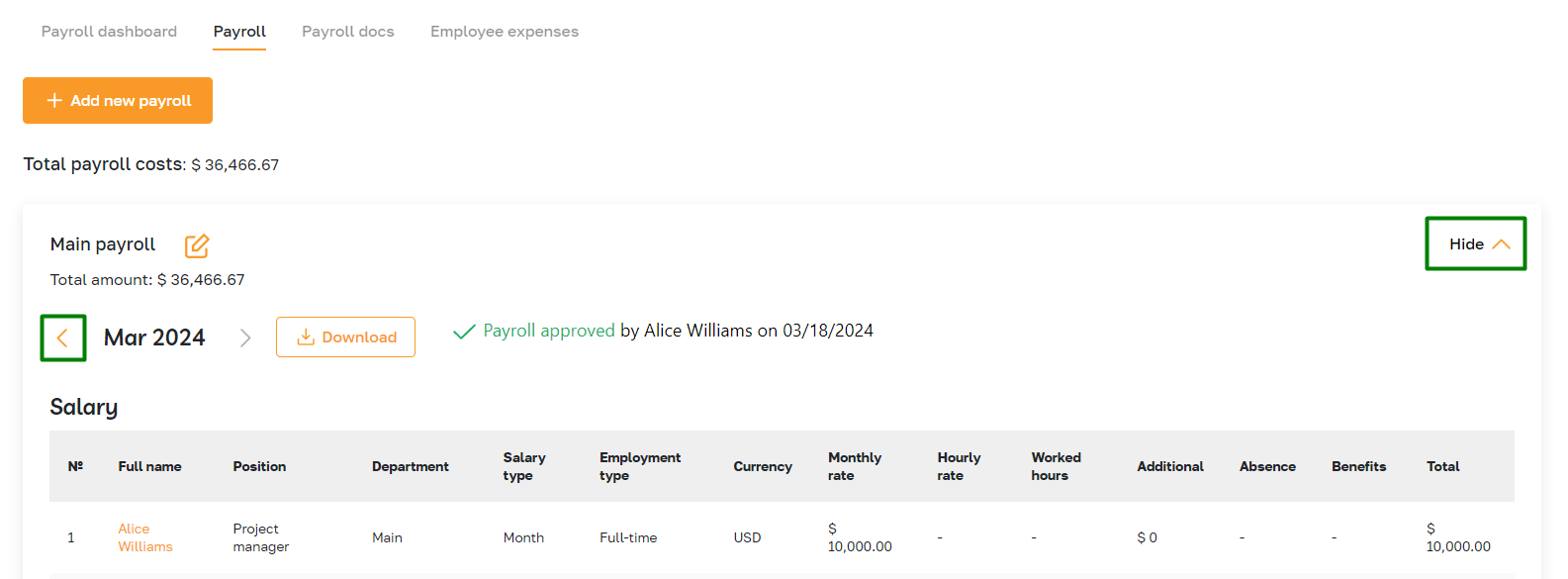

Approving payroll

Reviewing and approving the payroll before disbursing employee payments is crucial to ensure accuracy and compliance with company policies and regulations. The Approving Payroll function enables the admin to verify the payroll details, including employee salaries, deductions, and taxes, and authorize the release of funds for payment.

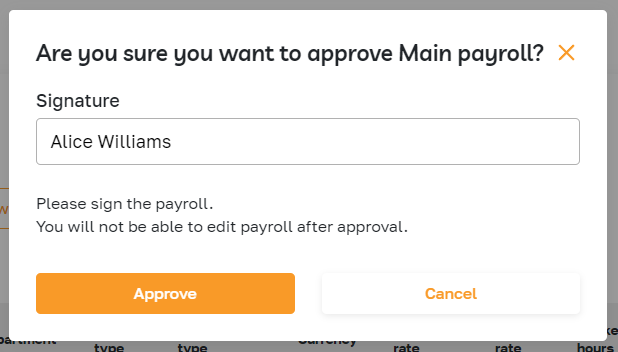

To approve the payroll, click on the highlighted button.

In the opened pop-up, enter your signature and confirm the action.

Please note that the electronic signature is legally binding.

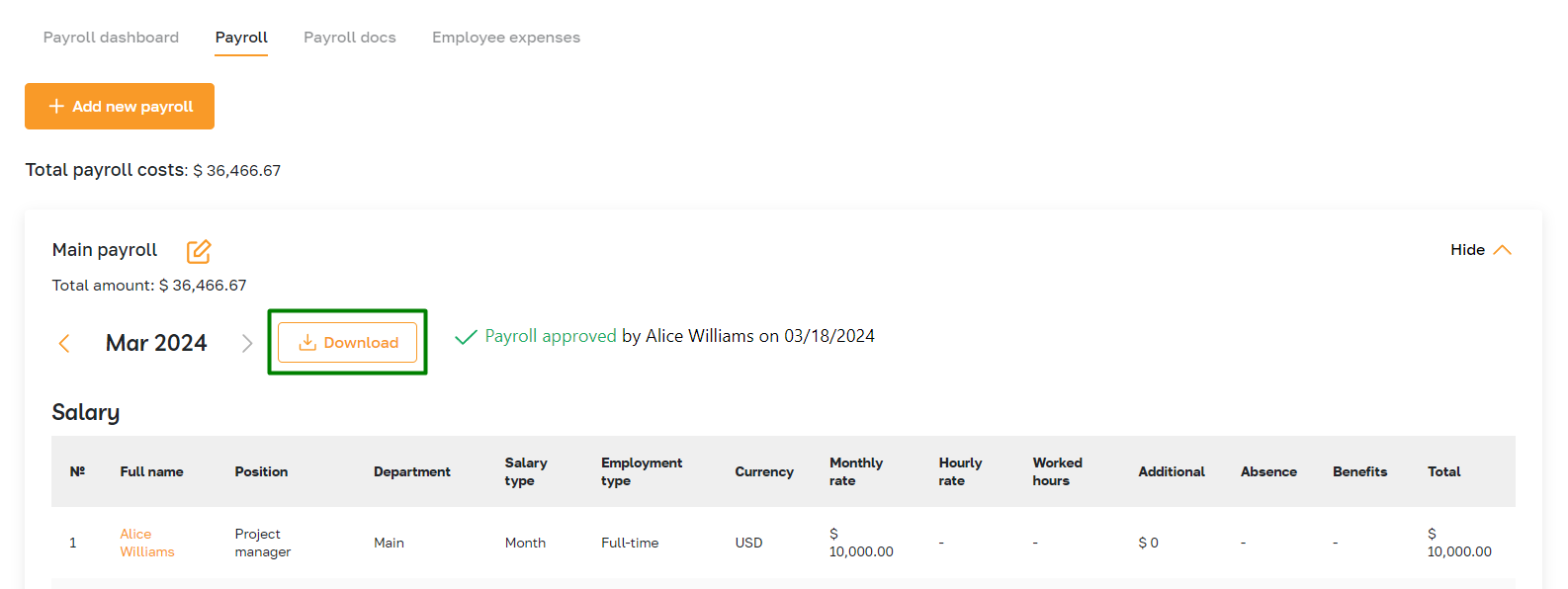

After approving the payroll, the admin cannot make any changes to the payroll for the current month.

The admin can download the generated payment document using the "Download" button or in the "Payroll docs" subsection.

Adding a new payroll

Please refer to this article for complete information on adding a new payroll.

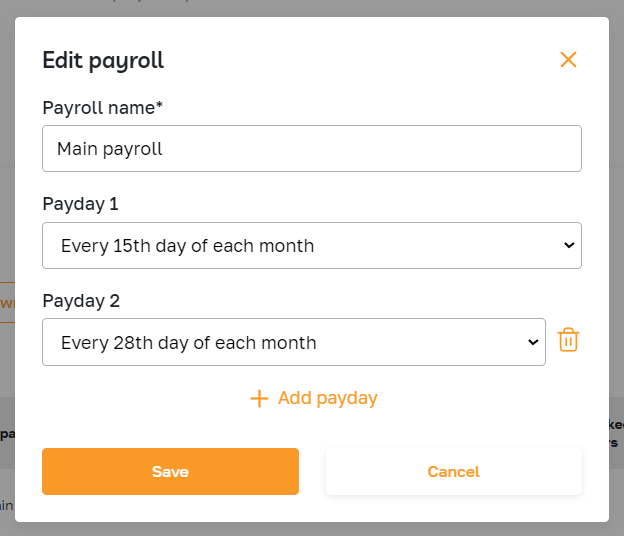

Editing payroll

To edit a payroll, click on the highlighted icon.

In the opened pop-up window, make the necessary changes and save them.

Deleting payroll

The admin can only delete additional payrolls. To delete a payroll, click the highlighted icon and confirm the action.

Please note that you cannot delete the payroll if your employees' salary payments are linked to it. To delete the payroll, you must first change the payroll in the employee profiles.